Your Money or Your Life by Robin and Dominguez

Citation

Robin, Vicki, et al. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018. 2008.

Quotes

- species:

- themes:

Collations

Nine Magical Steps To Create A New Roadmap

Step 1: Making Peace With The Past

A - How much have you earned in your life? Find out your total life earnings.

B - Find out your net worth by creating a personal balance sheet of assets and liabilities.

Step 2: Being In The Present - Tracking Your Life Energy

Money is something we choose to trade our life energy for.

A - How much are you trading your life energy for? Establish the actual cost in time and money required to maintain your job, and compute your real hourly wage.

You are in the business of selling the most precious resource in existence — your life energy. You had better know how much you are selling it for.

Your real hourly wage will become a vital ingredient in transforming your relationship with money.

B - Keep track of every cent that comes into or out of your life (Daily Money Log).

Step 3: Where Is It All Going? (The Monthly Tabulation)

- Every month create a table of all income and all expenses within categories generated by your own unique spending pattern.

- Balance your monthly income and outgo totals.

- Convert ‘dollars’ spent in each category to ‘hours of life energy,’ using your real hourly wage as computed in step 2.

This monthly tabulation will be an accurate portrait of how you are actually living and provide a foundation for the rest of the program.

Step 4: Three Questions That Will Transform Your Life

On your monthly tabulation, ask three questions of each of your category totals expressed as hours of life energy and record your responses:

- Did I receive fulfillment, satisfaction and value in proportion to life energy spent?

- Is this expenditure of life energy in alignment with my values and life purpose?

- How might this expenditure change if I didn’t have to work for a living.

- Mark a minus [-] or a down arrow if you did not receive fulfillment proportional to the hours of life energy you spent in acquiring the goods and services in that category, or if that expenditure wasn’t in full alignment with your values and purpose or if you could see expenses in that category diminishing after Financial Independence.

- Mark a plus sign [+] or an up arrow if you believe that upping this expenditure would increase fulfillment, would demonstrate greater personal alignment or would increase after Financial Independence.

- Mark zero [0] if that category is just fine on all counts.

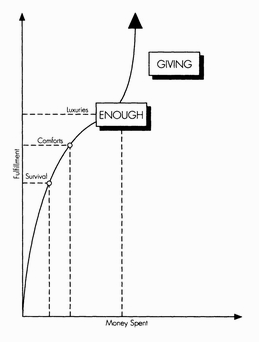

Asking yourself, month in, month out, whether you actually got fulfillment in proportion to life energy spent in each subcategory awakens the natural sense of knowing when enough is enough.

Step 5: Making Life Energy Visible

Create a large Wall Chart plotting your total monthly income and total monthly expenses from your monthly tabulation. Put it where you will see it every day.

Step 6: Valuing Your Life Energy — Minimizing Spending

Learn and practice intelligent use of your life energy (money) which will result in lowering your expenses and increasing your savings. This will create greater fulfillment, integrity and alignment in your life.

Step 7: Valuing Your Life Energy — Maximizing Income

Respect the life energy you are putting into your job. Money is simply something you trade your life energy for. Trade it with purpose and integrity for increased earnings.

Step 8: Capital And The Crossover Point

Each month apply the following equation to your total accumulated capital, and post the monthly independence income as a separate line on your Wall Chart:

Capital X current long-term interest rate 12 months = monthly investment income

- At the Crossover Point you will be financially independent. The monthly income from your investment capital will be equal to your actual monthly expenses.

- You will have enough.

- Your options will be wide open.

- Celebrate.

Step 9: Managing Your Finances

9 - Managing Your Finances

Joe Dominguez’ strategy

- Investing in U.S. treasury bonds to ensure maximum safety of capital and stability of income

No certainty

- There is no certain and foolproof method for making money effortlessly.

- “...no investment you make guarantees that geopolitical or economic conditions will not shift or protects you from finding that the nest egg you thought would give you a comfortable income for life . . . won’t. Buyer—of investments—beware."

Step 9

- Do your own research and think for yourself to determine which of these investment options is best for you.

- Become knowledgeable and sophisticated about long-term income-producing investments so that you can manage your finances for a consistent income sufficient to your needs over the long term.

- Learn enough to free yourself from fear and confusion that pervade the realm of personal investments.

EMPOWER YOURSELF

Stocks

- Your personal fortunes rise and fall with the company’s fortunes.

Bonds

- You are loaning money (principal) to a trustworthy institution at the best interest rate you can get for a set period of time, at the end of which you get your money back. All of it.

Investing is not equal to “more is better”

- You know how much is enough for you.

- The purpose of your investment program will be to assure yourself that you will have that amount - an then some - for the rest of your life.

Don’t Just Leave It to the Experts

- Don’t approach securities brokers for advice. Only use them when you have decided what to buy.

- For advice, only hire a “fee only” consultant so that your advisor will not benefit financially from any of the specific investments he/she recommends to you.

- Look for a consultant that supports the principles of YMOYL.

You and you alone are responsible for investing your money since no one cares about the outcome more than you. But in certain circumstances, hiring a trained professional guide can be very useful.

Become as knowledgeable as you can regarding your investment options.

Dispelling Fears

Most beliefs about investing rest on two primary driving forces

- Greed

- Fear

Fear: “Will I continue to have enough money over time?”

How to whittle this fear:

- Apply the investment criteria suggested at YMOYL

- Establish a reserve according to the guidelines at YMOYL

- Dispel the irrational fear of inflation.

Are Our Fears of Inflation Inflated?

- The morbid fear of inflation, has blinded us to some basic truths and has greatly distorted our perceptions. The financial industry has been quick to capitalize on this pervasive paranoia—with the resulting proliferation of many dubious “investment” vehicles.

- At least part of our experience of “inflation” is due to unconscious and automatic habits as well as to our chosen lifestyle, in addition to “the cost of living.

- CPI does not account for cultural change, technological improvements or creative substitutions. Therefore, the CPI often suggests that the impacts of inflation are much worse than they often actually are.

- While “inflation” may be a macroeconomic reality, this does not mean that it automatically rules your microeconomic life. Your choices, attitudes, beliefs, habits, tastes, fears and desires can have an enormous effect on your bottom line.

- Invest in yourself—in your own capacity to solve problems creatively, in your own inventiveness and adaptability, in your own skills and abilities—and you can at least keep hard-core inflation confined to a few areas of life, not sprawling across your whole existence. You don’t need to fear inflation—you just need to manage it rationally.

- You can hedge inflation more than you might think just through being conscious and making different choices—but not always and not forever.

Inflation and Investment Returns

The ultimate return on any long-term investment is determined by four primary factors:

- Annual rate of return

- Fees

- Taxes

- Effects of inflation over time

When inflation rates are low (3 percent or less), invest in conservative instruments (treasury bonds).

When inflation rates are high, consider taking more risk with your money to increase return.

You don’t want to risk your nest egg. But you are putting it at risk if your investment returns don’t keep pace with inflation.

How do you manage your money to reduce the risks associated with inflation?

3 PILLARS OF FINANCIAL INDEPENDENCE: CAPITAL, CUSHION, AND CACHE

- Capital - The sum that is invested, ultimately producing at least as much income as indicated but the Crossover Point.

- Cushion - A cash reserve that is enough to cover your expenses for six months. The purpose of the cushion is to handle emergencies and surges in expenses.

- Cache (pronounced “cash”): Additional savings beyond core capital or cushion.

Beginners Steps

- Build a cushion (Php 60,000).

- After building your cushion, transfer money into long-term investments.

- Determine what type of account to use for holding your cushion.

- Determine what type of account to use for holding the money that is accumulating, waiting to be invested.

- Compare the advantages of federally insured savings accounts, insured interest-paying checking accounts, money market accounts and CDs.

BASIC CRITERIA FOR INVESTING YOUR CAPITAL

Research and do homework.

Make smart and sensible decisions regarding your long-term investments.

The better you understand the options you have available for investing your capital, the more confidence you will have in your decisions.

Joe’s Basic Criteria

- Your capital must produce income.

- Your capital must be absolutely safe.

- Your capital must be in a totally liquid investment. You must be able to convert it into cash at a moment’s notice, to handle emergencies.

- Your capital must not be diminished at the time of investment by unnecessary commissions, “loads,” “promotional” or “distribution” expenses (often called “12b-1 fees”), management fees or expense fees.

- Your income must be absolutely safe.

- Your income must not fluctuate. You must know exactly what your income will be next month, next year and twenty years from now.

- Your income must be payable to you, in cash, at regular intervals; it must not be accrued, deferred, automatically reinvested, etc. You want complete control.

- Your income must not be diminished by charges, management fees, redemption fees, etc.

- The investment must produce this regular, fixed, known income without any further involvement or expense on your part. It must not require maintenance, management, geographic presence or attention due to “acts of God.

The investment vehicle that meets these criteria are U.S. treasury bonds.

Treasury Bonds

- Ideal for low risk tolerance

- Protect principal

- Provide a steady stream of income

- Relatively easy to understand

- Exempt from local and state taxes

- Can be bought and sold almost instantly with minimal handling charges

- Protected by the government

How to buy bonds

A. Disintermediation

- Buying bonds directly

- No middleman (fund, bank)

B. Broker

- Buy a bond through a broker for a minimal fee

C. Secondary Market

- Particular interest rate or maturity date for a premium

- Pay a minimal fee or commission upon purchase

D. Bond Index Fund

- Buy it through a brokerage house

- As long as the expense ratio is below 0.25 percent

- Better interest rate even with the slight fee

- TIPS bond fund

E. Global Bond Funds

- Over half the global marketplace

- An easy way to diversify your bond portfolio by adding some international exposure

- I-shares.com

- troweprice.com

- pimco.com

Buying foreign bonds

- Investigate your own nation’s government bonds.

- The fluctuations in currency exchange rates make the interest income payments unpredictable (only appropriate for more adventurous FI investors)

Helpful Terms

- Rate - the annual interest rate that the bond pays you in percentage

- Maturity or date - when the loan represented by the bond is repaid to you. Interest is paid semiannually on the day and month corresponding to the maturity date and six months later.

- Bid - the price at which a dealer offers to buy the bond

- Asked - the price which the dealer offers to sell the bond

- Chg - change in the bid price (up or down) since the previous day

- Yld - the yield to maturity in percentage. Current yield adjusted to take into consideration whether you bought it above or below par (the face value of the bond) and thus whether you’ll have a profit or a loss when the bond is repaid.

Alternatives to Treasury Bonds

- Putting your whole nest egg in treasury bonds when yields are low means a longer accumulation phase.

- You may accept a bit more risk by investing part of your nest egg in the stock market as safely as possible.

INVESTMENT OPTIONS

Mutual Funds

- Portfolios of stocks managed by professionals

- Frequently reflect some investment philosophy

- Strive for larger returns by investing in specific industries

- Charge more to compensate for the manager’s increased workload and for the use of their skills and talents

- They are not guaranteed to increase or to protect an investor’s initial investment

Index Funds

- Mutual funds designed to mimic the performance of stock market indices (Dow Industrials, NASDAQ, Composite, S&P 500)

- Low fees and cost

- Broad diversification

- Low portfolio trading activity

- No traditional active money management

- No bets on individual stocks

- Passive investment approach

- Larger share for investors

Low Fees

- Being FI means we know down to the penny the flow of money that comes into and out of our lives, which means that fees—especially low fees—matter to us. By using low-fee index funds as part of your core FI portfolio, you’re applying FI thinking at its best.

No-Load Funds

- 401(k), SSS, or PERA has a load

- If you don’t have a choice where to invest: carefully rearrange your investments to avoid fees for early withdrawal as much as possible

- When you have a choice: choose firms that offer no-load funds, carry no sales fees (loads) and don’t charge fees to cover marketing expenses

Actively Managed Funds or Index Funds?

- Choose index funds

- “Most investors are better off putting their money in low-cost index funds. A very low-cost index is going to beat a majority of the professionally managed money.”

- “Regardless of the asset class, use only index or passive asset class funds. Active management is a loser’s game. Diversify across many asset classes. This will reduce portfolio risk and probably increase returns as well.”

Designing your own “Enough and the Some” FI3 portfolio

Portfolio

- The sum of your investments across “asset classes” or types of investment vehicles (cash, bonds, stocks, real estate, foreign currency, and commodities)

Asset Allocation

- The art and science of distributing your nest egg across various classes to balance risk and reward.

- Wisely limiting your market risk by spreading your money across various asset classes.

- This is a smart, sensible and time-tested strategy.

Index Funds

- By using index funds, you can allocate your capital across various asset classes. This enables you to reduce volatility without giving up investment performance.

Lifestyle Funds

- A kind of mutual fund

- Management fees are low

- Plan is simple to manage

- Enables inexperienced investors to quickly establish a well-diversified portfolio that reduces market risk

- With the purchase of one mutual fund, you end up owning five funds spread across a variety of asset classes

- Takes the guesswork out of where and how to invest your capital

- Enables you to pick the asset allocation that fits your long-term investment objective.

- The fund automatically rebalances to maintain a consistent allocation among stocks, bonds and short-term investments.

Mark’s Vanguard FI Investment Strategy

A. Retirement (Life-Strategy Income Fund)

Seeks current income and has some growth of capital

60% to bonds

20% to short-term reserves

20% to common stocks

B. Balanced (Life-Strategy Conservative Growth Fund)

Balances your need for long-term growth of capital along with your need for income

Well-suited for investors at all stages of their journey to FI

40% to bonds

20% to short-term fixed income reserves

40% to common stocks

C. Moderate Growth (Life-Strategy Moderate Growth Fund)

Higher allocation to stocks (more potential for growth but more risk)

60% to common stocks

40% to bonds

D. Riskier ((Life-Strategy Growth Fund)

Invest during nest-egg accumulation phase

Seek long-term growth of capital with some income

Younger FIers

Willing to tolerate more risk

80% to common stocks

20% to bonds

SRI

- Socially responsible investing

- Merges quest for financial independence with humanitarian or environmental values

- socialinvest.org

- Expressing your environmental and social justice values (being good) doesn’t guarantee that you’ll maximize your income (doing well).

- Do your research.

- In general, funds with lower costs, more diversification and screening that matches your values will be your best bets.

CHECKLIST OF THINGS TO CONSIDER WHEN INVESTING

Is this investment in line with my values?

What are the federal, state and local tax implications of this investment for me? (Is it tax efficient for my income bracket or situation?)

How easily can I liquidate (sell out of) all or part of this investment?

What sales charges/penalties (if any) will I incur in getting into or out of this investment?

Does this provide the current/future income I need

Does this provide overall diversification for my investments?

Is this investment in line with my tolerance for risk?

OTHER INVESTMENTS

Real Estate

Community

- Invest in community

- Loan money to friends at an interest rate that’s better for you than bonds but lower for them than a bank

- Invest in a local business rather than making a loan

CUSHION

- 6 months of monthly expenses

- Readily available in a bank account or a money market fund

- Handle spikes in expenses

- Eases concern about consciousness growing faster than inflation

- Your cushion will be there to handle the “what if’” worries, either by proving them unfounded or by providing the cash needed to see you through.

CACHE

In your FI program, your cache is a store of extra money (beyond your capital or your cushion) that builds up for future use. Funds feeding the cache account come from numerous sources.

Sources

- Savings from a lifestyle with no paid employment

- Savings from continuous application of FI principles while income continuous to increase

- Savings from not buying new material possessions

- Savings from no taxes

- Incidental income

- Paid employment

How to Spend Cache

- You do not need this for your everyday living expenses

- Psychological function (you have enough and then some) helping to quell any lingering “what ifs."

- Handles the shortfall during inflation.

- It is from this fund that you can replace major items necessary to your chosen lifestyle when they finally do wear out.

- Projects and causes that you participate in may need an infusion of capital to achieve a specific objective; you can provide that capital without damaging your ability to provide that most valuable of contributions, your undivided life energy.

- Your cache is a living resource, not a one-time bundle that you will deplete.

8 - The Crossover Point: The Pot of Gold at the End of the Wall Chart

SAVINGS VERSUS CAPITAL

Capital

- The gap between your income and your expenses becomes savings which in turn becomes capital.

- Money that produces an income as surely as your job produces income

2 basic forms of investment

- Speculation

- Debt Instruments (Loans)

STEP 8: CAPITAL AND THE CROSSOVER POINT

Monthly Investment Income

- The income you receive from your capital.

- It comes in whether or not you go to work.

- Enter it separately on your Wall Chart.

- Formula: capital x long-term interest rate / 12 months = monthly investment income

- Apply the formula to your total accumulated savings each month

Total Accumulated Capital

- Savings that you are not planning to spend.

Current Interest Rate

- Use the current yield of long-term

THE CROSSOVER POINT

- That point in the foreseeable future when your total monthly expenses and monthly investment income crosses.

- Income from your investment capital is higher that your monthly expenses.

- At this point, you have Financial Independence. You will have a safe, steady income for life from a source other than a job.

- Your monthly investment income covers your basic life necessities and all the components of your chosen lifestyle.

- Once you’ve passed the Crossover Point you have choice about how you fill the hours of your day and the days of your productive life. You are free to invent your life.

THE POWER OF WORKING FOR A FINITE PERIOD OF TIME

- Wouldn’t you feel like putting a lot more of yourself into that job, knowing that it’s only for a limited period of time? Wouldn’t it make the boredom more bearable and the challenges more interesting?

- Knowing that you will only work for a finite and foreseeable period of time will make you an even more highly motivated, high-integrity worker.

- Concentrate on making money now so that you don’t have to make money later.

- Commit yourself to intensively earning money (without selling out your integrity or endangering your health) for a limited period of time.

2 Rockets of FI

- Primary Rocket: Aligning your earning and spending with your values and with what brings you true fulfillment.

- Secondary Rocket: The concept of working for a finite period of time.

FINANCIAL INDEPENDENCE: HAVING ENOUGH - AND THEN SOME

“And then some”

- Helps you feel totally comfortable to rely on your monthly investment income.

- Your FI lifestyle will cost less than your job-associated lifestyle.

- The money you save from this effect becomes your “and then some.”

- You can track this “and then some” income by putting a fourth line on your Wall Chart.

- Remember: your Wall Chart is a powerful antidote to anxiety about the future.

YOU CAN STOP WORKING FOR MONEY

- You don’t need to stop working for money but you can.

- Not working for money is not part of the FI program. It is an individual and personal choice.

- You can volunteer and not tie yourself to a salary and the compromises that tend to go along with it.

- You can work for money approaching it in a whole new way.

- Work can not be a process of discovering how to express your understanding of what life is rather than trying to make more money.

- Time with family and friends.

- Personal time

VOLUNTARY ACTION: THE FREEDOM TO CHOOSE WHAT YOU DO AND DO WHAT YOU CHOOSE

Working after FI is a choice, no longer an obligation.

Work is done anticipating fulfillment, not money.

Voluntary action can serve your values and your chosen purpose.

Volunteers

- Free to act whenever, wherever, and however they choose

- They work for their values and their deepest believes about life

- They work for love, not money

- They can venture into projects that later one provide job opportunities to others

- Because they are not paid professionals, volunteers can be experimental and intuitive.

- Volunteers are powerful by virtue of being free.

Amplifying Fulfillment through Volunteerism

2 choices at the point of maximum fulfillment

- Consume. Continue working for your needs and desires (buy possessions and experiences).

- Create. Work for something larger than yourself that gives to others and the world.

How to heighten fulfillment

- Once you have enough, it’s the commitment to giving that takes that fulfillment line straight up off the top of the chart.

- Make a contribution through service.

- The accumulation that constitutes your “enough” is about getting. The freedom above the peak is about giving—via work, attention, care and presence.

Freedoms of volunteering

- The freedom to do the kind of work you choose whether or not you have the credentials and whether or not you get paid for it.

- The freedom to speak the truth and never bend your principles for the sake of job security.

- The freedom to structure your time in a way that best works for you.

- The freedom to continue using the skills you already have and are comfortable with or to push yourself to learn new ones.

Foreword

A healthy relationship with money is just a by-product of living a happy, healthy life.

—

Which do you want to become?

- An ultra billionaire

- A lighthearted, productive, free person who never have to worry about money again

—

Universal happiness buttons

- Friendship

- Health

- Community

- Overcoming challenges with your own ingenuity

- Feeling in control

Money is not part of these universal happiness buttons. But it facilitates these buttons.

—

Aspire to get better slowly by repeating small steps every day.

Aspire not just to improve your financial picture. Aspire to improve you.

—

The amount of money you have or don’t have is just a symptom

The root of the problem is this:

- Your personal beliefs about money

- Your personal habits on money

Introduction

The goal of the program is this:

- To liberate your most precious resource—your time—to make room for more happiness, more freedom, and more meaning.

—

To get towards that goal, your need to:

- Transform your relationship with money

- Achieve Financial Independence

—

What does it mean to transform your relationship with money?

- It means knowing how much is enough money for you to have a life you love, now and in the future.

- It means shifting from being a victim of money and the economy to making conscious choices.

—

What does Finacial Independence mean?

- It means no longer having to work for money.

—

What does this process look like?

- You will be freed from the illusion that buying stuff will make you happy or that more is always better.

- You see clearly the thoughts driving your money patterns that the patterns themselves evaporate.

- As you apply the steps in the program, which involve increasing your income and cutting your expenses, you generate money you can use to pay of your debts.

- After paying off your debts, you naturally build up savings as you continue to apply the steps.

- Since you have savings, you no longer panic with unexpected expenses.

- Since saving has become a habit, you save more and more.

- Eventually, you have enough savings that you can start investing.

- Your invested money grows by itself giving you the power to choose whether to work for love or money.

—

Enough is what we aspire to.

Having more is an endless horizon.

—

To define what your enough is, you need to ask yourself:

- What makes you happy?

- What’s most important to you?

- What values will you never compromise?

- If you had $1 million right now, what would you do with your time?

- What’s one thing you could get rid of to make yourself happier? (A person doesn’t count.)

- Will you ever have enough money to retire?

- If someone today erased all your debts, would you dig yourself into that hole again? How or how not?

—

Successful FIers share two qualities to succeed:

- A purpose for their lives that’s greater than their current limited circumstance—including their jobs

- A willingness to do the work of change, to tell the truth, to be accountable, and to persist

—

People who follow this program are called FIers (FI means four things: Financial Intelligence, Financial Integrity, Financial Independence, Financial Interdependence).

A similar movement emerged from the original FIers: the FIRE movement (Financial Independence, Retire Early)

—

Three strands of the FIRE movement

- Frugality

- Simplicity

- Self-sufficiency

—

Other qualities of people who succeed:

- Accountability

- Self-awareness

- Empowerment

—

Two styles in following the program

- Turtles - Use the program slowly, steadily, and methodically.

- Hares - Set a deadline for motivation. Save more to retire as early as possible.

Whatever style you choose, the key is to start and keep going.

—

Financial Intelligence

The ability to step back from your assumptions and your emotions about money and observe them objectively.

It begins with knowing:

- how much money you already have earned

- how much money was left from all that you earned

- how much is coming into your life

- how much is going out of your life

It also involves understanding what money really is and what you are trading for the money in your life.

—

Financial Integrity

Achieved by learning the true impact of your earning and spending on you, your family, and the planet.

It involves knowing what is enough money and material needs you need to keep you at the peak of fulfillment.

It involves knowing what is excess and clutter.

It means your financial life is in alignment with your values.

—

Financial Independence

Being free from a dependence on money to handle your life.

—

Financial Interdependence

Helping make the world a better place AFTER achieving financial independence and pursuing your dreams.

Chapter 1: The Money Trap: The Old Road Map for Money

There is a way to live an authentic, productive, meaningful life—and have all the material comforts you want or need. There is a way to balance your inner and outer lives, to have your job self be on good terms with your family self and your deeper self. There is a way to go about the task of making a living so that you end up more alive.

You can choose both money and life.

—

One needs to think about what life is outside a money-generating job. Because even the best jobs have trade-offs. There is a larger arena we could enjoy, one that is beyond tthe world of 9-5. It is possible to do work we love with no limitations or restraints and no fear of getting fired or losing clients.

—

Some people are too psychologically attached to a bad job (for identity and self-worth) that they don’t leave even if they are financially capable of doing so.

Our jobs have replaced family, neighborhood, civic affairs, church, and even partners as our primary allegiance, our principal source of love and site of self-expression.

—

Jobism

A hidden hierarchy in society that categorizes people based on what they do for money.

—

We are working more, but enjoying life less.

On top of that, we are not saving more.

Invest in passively managed, low-fee index funds diversified over a few asset classes and hold them for many years.

Diversify your index funds across asset classes.

- Stocks

- Bonds

- Domestic

- International

- Large, medium, or small capital funds

References

Robin, V., Dominguez, J., & Mustache, M. M. (2008). Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018.